What did Mengniu say at the performance meeting today? See for yourself

- Categories:Industry news

- Author: 小食代

- Origin: 小食代

- Time of issue:2021-03-25

- Views:816

(Summary description)Mengniu, which has recovered from the 2020 pandemic crisis, is pointing to the new strategic goal of "creating a new Mengniu in five years."

To

Today, Mengniu Dairy (2319.HK) released its 2020 financial report, with revenue reaching 76.034.8 billion yuan (RMB, the same below; 2019: 79.299 billion yuan), a year-on-year decrease of 3.8%. Excluding the business income of Junlebao sold in 2019 and Bellamy's acquired in 2019, the group's comparable business income was 75.03 billion yuan (2019: 67.817 billion yuan), a year-on-year increase of 10.6%. To

To

To

According to the financial report, in 2020, Mengniu's profit reached 3.525 billion yuan (2019: 4.1055 billion yuan), a year-on-year decrease of 14.1%. Mengniu said that this was mainly due to a number of additional expenses caused by the epidemic in the first quarter of 2020. The company pointed out that with the gradual easing of the epidemic in the second quarter, the business will achieve a strong recovery starting in the second quarter of 2020, especially liquid milk.

To

"In the case of the epidemic, it is very difficult for us to achieve such results." Mengniu President Lu Min said at the performance meeting held today. The overall employee income has increased slightly compared to 2019. "This also reflects our overall performance. Performance."

To

Xiaoshidai learned that in the above-mentioned meeting, the management of Mengniu and Yashili, including Lu Min, further interpreted the performance of each business sector in 2020, and talked about the expectations for 2021 and "create another one in the next five years." "New Mengniu" strategic plan.

To

To

Let's pay attention together.

To

Multiple business growth under the epidemic

To

At the meeting, Lu Minfang said that the performance achieved last year was partly due to channel development and digital transformation. "In 2020, we will develop new retail channels, build new retail business units for various business units, and strengthen e-commerce, O2O, and community platforms. In addition, our digital platform-driven "town-village" model has gained success in the second half of last year. Very good development." He said.

To

He said that in 2020, Mengniu has promoted the entire group's digital strategic projects, especially in the room temperature business unit, including applications such as "Niu NIU Hui", "Morning Glory", and "Niu Yun Hengtong", which greatly improved the room temperature business. The integration of online and offline capabilities.

To

To

Let's look at it by business sector.

To

The financial report shows that Mengniu will achieve rapid growth throughout 2020 in its normal temperature business. Mengniu pointed out that room temperature liquid milk has achieved double-digit growth for five consecutive years, and Mengniu's pure milk growth rate has reached 20%; the high-end product Delunsu has achieved a growth rate of 19% in 2020; and the real fruit granule series products have achieved a growth rate of 12%. increase.

To

"Faced with the early stage of the epidemic that hindered its sales channels, Mengniu firmly implemented its intensive channel cultivation strategy, accelerated the development of digital marketing and channel sinking in the township market, and swiftly deployed O2O home-to-home business, fresh food shopping platforms and community group buying and other emerging channels, with market share and The market rate of shops has increased significantly.” The company said.

To

To

In the fresh milk and cheese business, Lu Minfang said that last year's performance was "more eye-catching."

To

"Our fresh milk has doubled its net income for two consecutive years, and its market share has increased from 4.1% to 11.2%. Since June last year, it has become the second largest in the industry. Daily Fresh has also consolidated its presence in the high-end fresh milk market. The status of the first brand has achieved a year-on-year growth of 150%." He said. Currently, the business in this sector includes two major brands: Daily Fresh and Modern Ranch.

To

In addition, in the cheese business, Mengniu “has achieved triple-digit growth in both revenue and net profit” last year, with retail cheese growth exceeding 130% and catering cheese growth by 30%. Last year, Mengniu and European dairy giant Arla Foods jointly established the high-end cheese brand Aishi Chenxi, and cooperated in research and development innovation, brand promotion, channel operation and factory construction.

To

To

"We are very optimistic about the future prospects of the cheese market, especially our investment in Microcolando. Such strategic investment and future strategic synergy will help Mengniu achieve its absolute number one position in the Chinese cheese market." Lu Minfang Said today.

To

In the low-temperature business, Mengniu said that by continuing to promote the value marketing of low-temperature yogurt and low-temperature lactic acid bacteria, product innovation and

What did Mengniu say at the performance meeting today? See for yourself

(Summary description)Mengniu, which has recovered from the 2020 pandemic crisis, is pointing to the new strategic goal of "creating a new Mengniu in five years."

To

Today, Mengniu Dairy (2319.HK) released its 2020 financial report, with revenue reaching 76.034.8 billion yuan (RMB, the same below; 2019: 79.299 billion yuan), a year-on-year decrease of 3.8%. Excluding the business income of Junlebao sold in 2019 and Bellamy's acquired in 2019, the group's comparable business income was 75.03 billion yuan (2019: 67.817 billion yuan), a year-on-year increase of 10.6%. To

To

To

According to the financial report, in 2020, Mengniu's profit reached 3.525 billion yuan (2019: 4.1055 billion yuan), a year-on-year decrease of 14.1%. Mengniu said that this was mainly due to a number of additional expenses caused by the epidemic in the first quarter of 2020. The company pointed out that with the gradual easing of the epidemic in the second quarter, the business will achieve a strong recovery starting in the second quarter of 2020, especially liquid milk.

To

"In the case of the epidemic, it is very difficult for us to achieve such results." Mengniu President Lu Min said at the performance meeting held today. The overall employee income has increased slightly compared to 2019. "This also reflects our overall performance. Performance."

To

Xiaoshidai learned that in the above-mentioned meeting, the management of Mengniu and Yashili, including Lu Min, further interpreted the performance of each business sector in 2020, and talked about the expectations for 2021 and "create another one in the next five years." "New Mengniu" strategic plan.

To

To

Let's pay attention together.

To

Multiple business growth under the epidemic

To

At the meeting, Lu Minfang said that the performance achieved last year was partly due to channel development and digital transformation. "In 2020, we will develop new retail channels, build new retail business units for various business units, and strengthen e-commerce, O2O, and community platforms. In addition, our digital platform-driven "town-village" model has gained success in the second half of last year. Very good development." He said.

To

He said that in 2020, Mengniu has promoted the entire group's digital strategic projects, especially in the room temperature business unit, including applications such as "Niu NIU Hui", "Morning Glory", and "Niu Yun Hengtong", which greatly improved the room temperature business. The integration of online and offline capabilities.

To

To

Let's look at it by business sector.

To

The financial report shows that Mengniu will achieve rapid growth throughout 2020 in its normal temperature business. Mengniu pointed out that room temperature liquid milk has achieved double-digit growth for five consecutive years, and Mengniu's pure milk growth rate has reached 20%; the high-end product Delunsu has achieved a growth rate of 19% in 2020; and the real fruit granule series products have achieved a growth rate of 12%. increase.

To

"Faced with the early stage of the epidemic that hindered its sales channels, Mengniu firmly implemented its intensive channel cultivation strategy, accelerated the development of digital marketing and channel sinking in the township market, and swiftly deployed O2O home-to-home business, fresh food shopping platforms and community group buying and other emerging channels, with market share and The market rate of shops has increased significantly.” The company said.

To

To

In the fresh milk and cheese business, Lu Minfang said that last year's performance was "more eye-catching."

To

"Our fresh milk has doubled its net income for two consecutive years, and its market share has increased from 4.1% to 11.2%. Since June last year, it has become the second largest in the industry. Daily Fresh has also consolidated its presence in the high-end fresh milk market. The status of the first brand has achieved a year-on-year growth of 150%." He said. Currently, the business in this sector includes two major brands: Daily Fresh and Modern Ranch.

To

In addition, in the cheese business, Mengniu “has achieved triple-digit growth in both revenue and net profit” last year, with retail cheese growth exceeding 130% and catering cheese growth by 30%. Last year, Mengniu and European dairy giant Arla Foods jointly established the high-end cheese brand Aishi Chenxi, and cooperated in research and development innovation, brand promotion, channel operation and factory construction.

To

To

"We are very optimistic about the future prospects of the cheese market, especially our investment in Microcolando. Such strategic investment and future strategic synergy will help Mengniu achieve its absolute number one position in the Chinese cheese market." Lu Minfang Said today.

To

In the low-temperature business, Mengniu said that by continuing to promote the value marketing of low-temperature yogurt and low-temperature lactic acid bacteria, product innovation and

- Categories:Industry news

- Author: 小食代

- Origin: 小食代

- Time of issue:2021-03-25

- Views:816

Mengniu, which has recovered from the 2020 pandemic crisis, is pointing to the new strategic goal of "creating a new Mengniu in five years."

Today, Mengniu Dairy (2319.HK) released its 2020 financial report, with revenue of 76.034 billion yuan (RMB, the same below; 2019: 79.299 billion yuan), a year-on-year decrease of 3.8%. Excluding the business income of Junlebao sold in 2019 and Bellamy's acquired in 2019, the group's comparable business income was 75.03 billion yuan (2019: 67.817 billion yuan), a year-on-year increase of 10.6%.

According to the financial report, in 2020, Mengniu's profit reached 3.525 billion yuan (2019: 4.1055 billion yuan), a year-on-year decrease of 14.1%. Mengniu said that this was mainly due to a number of additional expenses caused by the epidemic in the first quarter of 2020. The company pointed out that with the gradual easing of the epidemic in the second quarter, the business will achieve a strong recovery starting in the second quarter of 2020, especially liquid milk.

"In the case of the epidemic, it is very difficult for us to achieve such results." Mengniu President Lu Min said at the performance meeting held today that overall employee income has increased slightly compared to 2019. "This also reflects our overall performance. Performance."

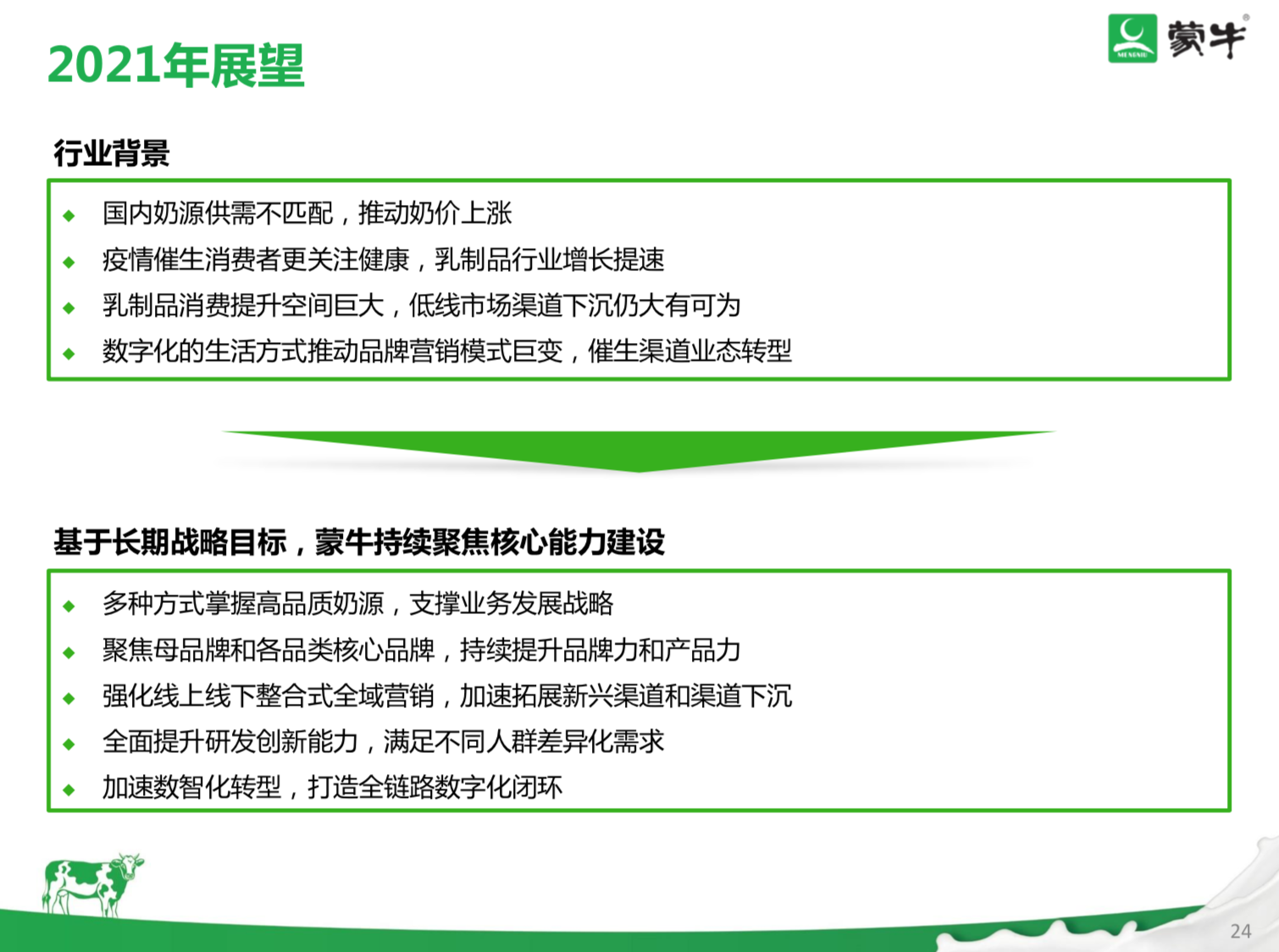

Xiaoshidai learned that in the above-mentioned meeting, the management of Mengniu and Yashili, including Lu Min, further interpreted the performance of each business sector in 2020, and talked about the expectations for 2021 and "create another one in the next five years." "New Mengniu" strategic plan.

Let's pay attention together.

Multiple business growth under the epidemic

At the meeting, Lu Minfang said that the performance achieved last year was partly due to channel development and digital transformation. "In 2020, we will develop new retail channels, build new retail business units for various business units, and strengthen e-commerce, O2O, and community platforms. In addition, our digital platform-driven "town-village" model has gained success in the second half of last year. Very good development." He said.

He said that in 2020, Mengniu has promoted the entire group's digital strategic projects, especially in the room temperature business unit, including applications such as "Niu NIU Hui", "Morning Glory", and "Niu Yun Hengtong", which greatly improved the room temperature business. The integration of online and offline capabilities.

Let's look at it by business sector.

The financial report shows that Mengniu will achieve rapid growth throughout 2020 in its normal temperature business. Mengniu pointed out,Room temperature liquid milk has achieved double-digit growth for five consecutive years. Mengniu's pure milk growth rate has reached 20%; the high-end product Deluxe has achieved a 19% growth in 2020; and the real fruit granule series products have achieved a 12% growth.

"Faced with the early stage of the epidemic that hindered its sales channels, Mengniu firmly implemented its intensive channel cultivation strategy, accelerated the development of digital marketing and channel sinking in the township market, and swiftly deployed O2O home-to-home business, fresh food shopping platforms and community group buying and other emerging channels, with market share and The market rate of shops has increased significantly.” The company said.

In the fresh milk and cheese business, Lu Minfang said that last year's performance was "more eye-catching."

"Our fresh milk has doubled its net income for two consecutive years, and its market share has increased from 4.1% to 11.2%. Since June last year, it has become the second place in the industry. Daily Fresh has also consolidated its presence in the high-end fresh milk market. The status of the first brand has achieved a year-on-year growth of 150%." He said.Currently, the business in this sector includes two major brands: Daily Fresh and Modern Ranch.

In addition, in the cheese business, Mengniu “has achieved triple-digit growth in both revenue and net profit” last year, with retail cheese growth exceeding 130% and catering cheese growth by 30%.Last year, Mengniu and European dairy giant Arla Foods jointly established the high-end cheese brand Aishi Chenxi, and cooperated in research and development innovation, brand promotion, channel operation and factory construction.

"We are very optimistic about the future prospects of the cheese market, especially our investment in Microcolando. Such strategic investment and future strategic synergy will help Mengniu achieve its absolute number one position in the Chinese cheese market." Lu Minfang Said today.

In the low-temperature business, Mengniu said that by continuing to promote the value marketing of low-temperature yogurt and low-temperature lactic acid bacteria, product innovation and RTM channel construction, it has maintained the number one market share in the low-temperature category for 16 consecutive years. However, affected by the epidemic and intensified competition, although the low temperature business revenue performed better than the industry, it still recorded negative growth.

In addition, in the ice cream business, Lu Minfang said that in 2020, focusing on brand renewal and product upgrades, a small positive growth has been achieved. "Our sales force in modern channels and new retail channels has been particularly improved, and sales and profit margins have been greatly improved. It is expected that our ice cream product structure will be further significantly improved and upgraded in 2021." He said .

Yashili and Bellamy

Focus on the performance of the milk powder sector.

In the milk powder business, Yashili International Holdings Co., Ltd. (1230.HK), in which Mengniu holds about 51% of the shares, will achieve steady growth in sales in 2020.According to the financial report released by Yashili today, revenue in 2020 will reach 3.649 billion yuan, an increase of 7% year-on-year; the sales revenue of milk powder products will be 2.975 billion yuan, an increase of 12.3% year-on-year, and the sales revenue of prepared products will be 166.4 million yuan, an increase of 16.2% year-on-year. The sales revenue of milk powder products was 427.4 million yuan. In 2020, Yashili's net profit will be 101.1 million yuan.

“Yashili’s annual sales revenue grew steadily, mainly due to our continued development of organic products in the infant powder market, increasing the overall organic product market share, and cultivating goat milk powder channels.” Yan Zhiyuan, President of Yashili, said today. In addition, Yashili is committed to Expanding the coverage of new functional products such as adult powder and nutritional products, developing towards high-end, while developing market segments, coupled with increased brand exposure, has promoted the growth of online and offline sales.

Xiaoshidai noticed that at the performance meeting, Yan Zhiyuan, the two major initiatives of "brand renewal" and "model building", achieved initial results in the infant formula business. "Through two approaches, our core large single products increased by 102% from the previous half of the year." He said.

Regarding adult milk powder, he said that due to the obvious aging trend, the consumer demand for adult powder has grown very well. "Last year, Yashili's adult fans increased by 52% year-on-year. We made four major actions to seize the opportunities of adult fans, namely strengthening the distribution of outlets, optimizing product portfolio, enhancing single-point sales, and exploring opportunities for emerging channels." He says.

Bellamy, an Australian manufacturer of organic infant formula and baby food that Mengniu acquired at the end of 2019, is also an important member of Mengniu's International Business Unit. Mengniu said that in 2020, the Bellamy brand will continue to expand its product line and quickly deploy offline channels in China to develop distribution networks in first- to third-tier cities in China.

In terms of new products, Bellamy launched a Chinese version of organic rice noodle supplement products last year; released the first ultra-high-end organic A2 milk powder and the first Zhichun series organic A2 goat milk powder in Australia, and synchronized them in China through cross-border e-commerce platforms. Market launch, completing the organic full matrix layout of the high-end segment of infant formula milk powder; launching the Chinese version of Jingyue organic infant formula milk powder in offline channels. To

Mengniu said that relying on the launch of the Chinese version of Jingyue's organic baby powder, Bellamy quickly deployed offline channels in China and developed a distribution network in the first to third tier cities in China. As of the end of 2020, the products have covered nearly 3,000 stores in 13 provinces. During the year, cross-border e-commerce channels performed brilliantly. The overall ranking of the annual merchandise turnover of infant powder noodles rose to fifth, and the growth of infant rice noodles was strong, ranking first in the category of organic rice noodles in cross-border e-commerce channels.

“In general, Bellamy’s business has met our expectations. Although online shopping agents have been affected, the growth of other channels has exceeded our target. Therefore, we expect Bellamy to have a better performance in 2021. A performance." Lu Minfang said.

Goals for the next 5 years

Xiaoshidai introduced that in December last year, Mengniu first proposed a five-year strategic plan to "create a new Mengniu". "In the past 21 years, we have created a Mengniu worth nearly 80 billion. We will use five years to create a new Mengniu system." Lu Minfang said today that he has made a clear 5 Strategic planning for the year.

At the same time, Lu Minfang said that this requires Mengniu to build five core capabilities.

"The first is the ability of digital marketing, including all-digital supply chain, all-digital marketing, consumer operations, etc., Mengniu's digitalization will be comprehensively raised to a new level." He said, the second is R&D and innovation capabilities. ; The third is the ability to control milk sources, "relying on the three major dairy companies of Modern Animal Husbandry, Shengmu, and Fuyuan, we have a very good layout in the upstream milk sources"; the fourth is the ability to acquire and integrate; the fifth is the organization Guarantee capacity.

"Let’s look forward to the portrait of Mengniu in the next five years. What will Mengniu look like by 2025? In addition to achieving our financial targets, we also hope that we will become a consumer’s favorite Mengniu, a digital Mengniu, and an international company. A modernized Mengniu, a Mengniu with a strong cultural gene." He said.

Xiaoshidai noticed that he mentioned at the meeting that since Mengniu's business recovered well in the second half of last year, for the next five years of development, the production capacity layout will still be implemented in accordance with the strategic plan in 2020.

"(Last year) our capital expenditure was 400 million yuan, reflecting our new factories and new production lines (expenses). In other words, the epidemic has not affected our strategic planning for the next three or five years. Instead, we firmly implemented our strategic layout during the epidemic," he said.

Looking forward to 2021, Lu Minfang gave several predictions.

"First, there is still a certain contradiction between the supply and demand of our entire domestic milk source, which will cause the price of milk to continue to rise. Second, we see that after the epidemic, the entire dairy product consumption is relatively vigorous, and the growth rate is also sustainable. Yes, and we also see that there is still a lot of room for channel sinking. Finally, I think the digital lifestyle will promote a huge change in our brand to consumer operations." He said.

"This is why we will especially strengthen our digital operation capabilities in the next 2021." Lu Minfang said that digital transformation will be a tough battle. "The entire group has established a digital project team. I personally take charge. Comprehensive promotion in various business sectors such as room temperature, low temperature and fresh milk."

Scan the QR code to read on your phone

PRODUCT AND SOLUTION

HANGZHOU ZHONGYA MACHINERY CO., LTD. CHINA ALL RIGHTS REVERSED.

powered by www.300.cn